Understanding the associated costs is crucial. This is where mortgage calculator wi come into play. These online tools are designed to provide you with a comprehensive overview of your potential mortgage, helping you make informed decisions.

Types of Mortgage Calculator WI

Simple Mortgage Calculator

The simple mortgage calculator is a basic loan amount, interest rate, and loan term. It’s perfect for those seeking a quick overview without delving into intricate details.

Advanced Mortgage Calculator

On the other hand, the advanced mortgage calculator offers a more detailed analysis. It considers additional factors like property taxes, insurance, and extra payments, giving you a more accurate portrayal of your financial commitments.

Key Components of a Mortgage Calculator

Understanding the key components is vital when using a mortgage calculator. Monthly payments and overall loan cost.

How to Use a Mortgage Calculator WI

Using a mortgage calculator may seem daunting at first, but it’s a user-friendly process. Begin by inputting your loan amount, interest rate, and loan term. The calculator will then generate your estimated monthly payments. Take the time to understand these results to make informed decisions.

Benefits of Using a Mortgage Calculator

Financial Planning

Mortgage calculators act as powerful tools for financial planning. They help you foresee your monthly expenses, enabling strains.

Budgeting Assistance

Whether you’re a first-time homebuyer or considering refinancing, a mortgage calculator assists in creating a realistic budget. It considers all relevant factors, preventing surprises down the line.

Common Mistakes to Avoid

Overlooking Additional Costs

One common mistake is focusing solely on the mortgage payment and overlooking additional costs like property taxes, insurance, and potential maintenance expenses.

Ignoring Interest Rate Fluctuations

Interest rates can vary, impacting your monthly payments. Failing to consider potential fluctuations can lead to inaccurate estimations.

Tips for Choosing the Right Mortgage Calculator

Customizable Features

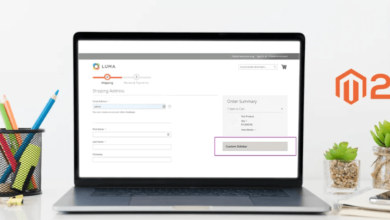

Look for mortgage calculators with customizable features. Providing a more accurate representation of your financial scenario.

User-Friendly Interface

Choose a calculator with a user-friendly interface. This ensures a smooth experience, even for those unfamiliar with financial jargon.

Real-Life Scenarios

Explore real-life scenarios where individuals successfully utilized mortgage calculators. These case studies highlight the effectiveness of these tools in making informed decisions and achieving financial goals.

Comparison with Professional Financial Advice

While mortgage calculators are powerful, they have limitations. Know when to seek professional financial advice, especially in complex financial situations.

Frequently Asked Questions about Mortgage Calculators

How Accurate Are Mortgage Calculators?

Mortgage calculators provide accurate estimates based on the information you input. However, external factors like market fluctuations can influence the final figures.

Can They Predict Changes in Interest Rates?

Mortgage calculators can’t predict future interest rate changes. Staying informed about market trends and adjusting your calculations is crucial. Read more…

Conclusion

In conclusion, mortgage calculators are invaluable for purchasing a home or refinance. They empower individuals to make informed financial decisions, offering a clear picture of their mortgage commitments. By incorporating mortgage calculators into your planning process, you take a significant step towards achieving your homeownership goals.

FAQs

- What Factors Affect Mortgage Calculations?

- The loan amount, interest rate, loan term, property taxes, and insurance influence mortgage calculations.

- Are Online Mortgage Calculators Reliable?

- Yes, online mortgage calculators are reliable with accurate and up-to-date information. However, they are estimations and may not account for all variables.

- Can a Mortgage Calculator Estimate Property Taxes?

- Some mortgage calculators include an option to input property taxes, providing a more comprehensive estimate of your monthly expenses.

- How Often Should I Update My Mortgage Calculator Inputs?

- It’s advisable to update your inputs regularly, especially when there are changes in interest rates, property taxes, or your financial situation.

- Is There a Difference Between a Mortgage Calculator and a Loan Officer’s Estimate?

- Yes, there can be differences. A loan officer’s estimate may include additional fees and considerations that a mortgage calculator might not account for. It’s essential to compare both for a comprehensive understanding.